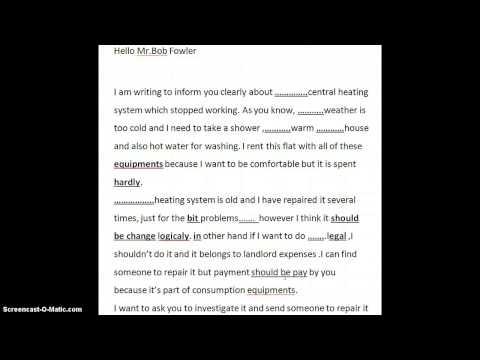

Hi Adele, thank you for this letter. Hello Mr. Bob Fowler, I am writing to inform you clearly about the central heating system, which stopped working. So, you started from the very beginning. I am writing to inform you, so I can see here that you're talking about a formal letter, very good. About the central heating system, so central heating system, you've got the adjectives and you've got the noun because it is a topic that is well known. Everybody knows what a central heating system is. We're going to use a certain determiner, if you like. Another word for what is needed here would be an article. But I'd like you to think about what article could go there. Remember, central heating system is something that is well known to everybody. So, what article do you think would be needed there? I'm writing to inform you clearly about something, the central heating system, which stopped working. Okay, as you know, we don't really need this extra space. Thank you. Come on, whether. The weather is too cold again. Weather is an aspect which is very well known to everybody. So, once again, we're going to use it with a specific article. Please. So, I'm going to underline this once again. Think about what article we would use there for the weather. With a central heating system, some of these are aspects, topics that are well known to everybody. So, they have a specific article. Whether it's too cold and I need to take a shower. Warm house again. House is a topic which is well known to everybody. So, we're going to underline this again. Again, the same article you would use here, you use here, and you will use here. The same article is used in all...

Award-winning PDF software

Landlord to tenant sample letters Form: What You Should Know

This package shows and describes forms and other publications that are related to the 2024 tax year. (NR-1040). The 2024 Federal Income Tax tables provide 2024 information. This package does not contain information about 2024 returns filed for that year. For detailed information about filing and payment of the 2024 income tax, see, 2024 Form 1040-ES, Estimated Tax for Individuals, and the 2024 instructions for form 1040-ES include information for nonresidents living abroad (NR-1040). For those who need to complete annual income tax returns from abroad, see Foreign income and foreign tax credits. For more information about the income tax forms used for foreign earned income and foreign housing expenses, see, Form 8965, Foreign Earned Income (Filing Status: Surviving Spouse). 2022 Form 1040-ES — IRS 2022 Form 1040-NR — Income Tax Return, for details on income that is taxable. Estimated tax for Form 1040-NR (NR-4022) is used by U.S. citizens living abroad who file separate returns for 2022. Information about paying your estimated tax is available for people with income from foreign sources that is taxed at a rate under 10 percent if they are U.S. residents or nonresident aliens by a foreign country. Individuals must file Form 1040NR if they report more than 10,000 of worldwide income (unless exempted by the government) in the year for which they are filing. If you are an employer, and you report wages and other compensation on Form W-2, you should see “If, In What Year, May I Claim the Child Tax Credit in a Filing Status Different from the One for Which the Credit Was Based?” on Form 1040A, Wage and Tax Statement, and on the Instructions for Form W-2. However, a U.S. resident who receives compensation or services from foreign sources from any country in an amount greater than U.S. 500 in the year for which Form 1040A was filed must claim the foreign earned income credit or the foreign housing deduction. If you receive compensation or services from foreign sources outside the U.S. for more than U.S.

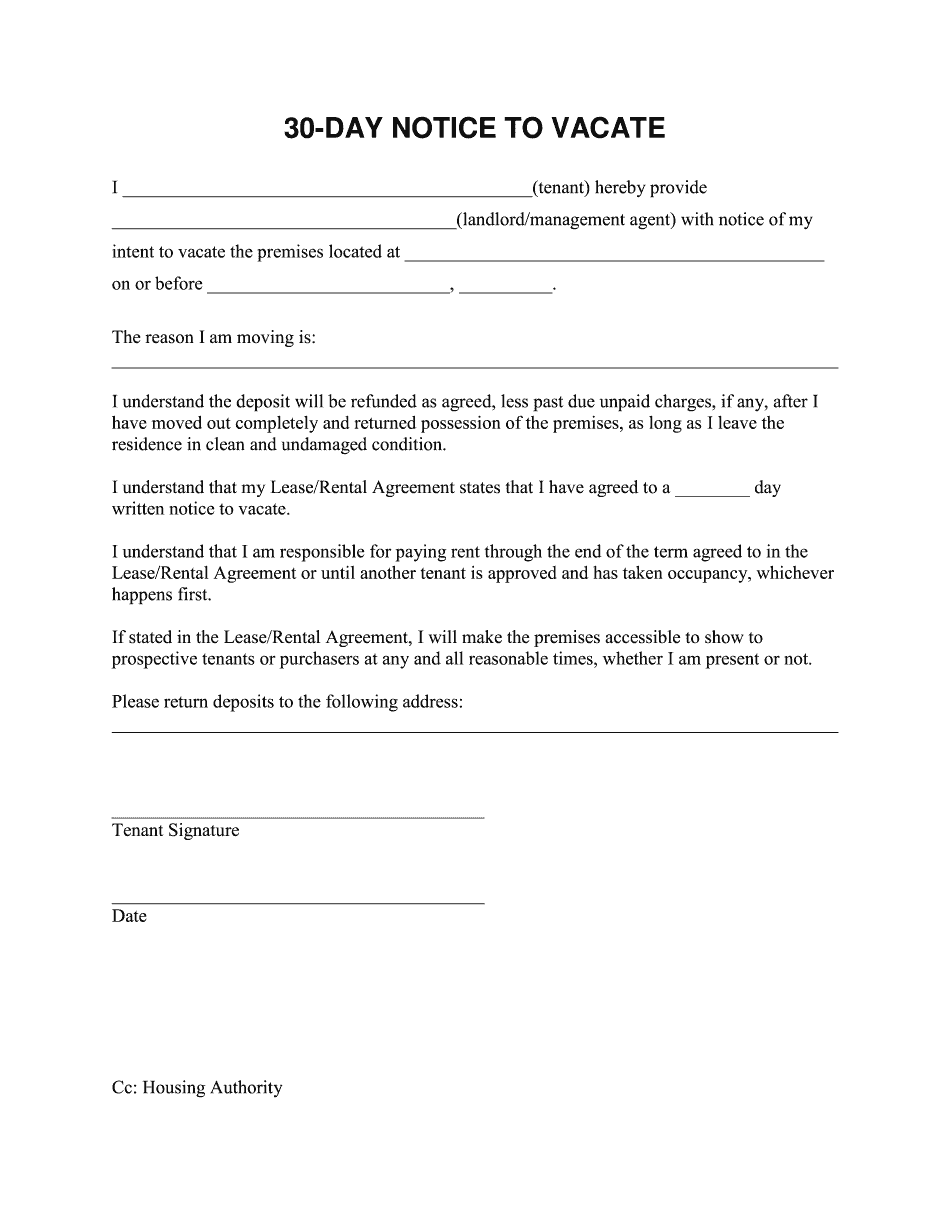

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do 30 Day Notice To Vacate, steer clear of blunders along with furnish it in a timely manner:

How to complete any 30 Day Notice To Vacate online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your 30 Day Notice To Vacate by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your 30 Day Notice To Vacate from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Landlord to tenant sample letters