Hello, this is Michael Alder from Taking Action Today. In this video, I want to show you how to fill out and serve a three-day eviction notice for your rental properties. Now, this video is strictly just a basic overview guide. You should always, always, always seek legal counsel when you're doing this. So, talk to your attorneys. But this is just a video to give you an idea of how the process works and how I handle these situations in my own investing. So, here we have a notice to leave premises. This is where you would write your tenant's name. So, let's say "Jane Doe". It says, "I wish you to leave the following described premises, now in your occupation, situated in the city of [insert city name], county of [insert county name], and the state of [insert state name]. So, for me, it would be the city of Cleveland, county of Cuyahoga, and the state of Ohio. You put whatever state you're in if you're not in Ohio. As known as [insert the address]. So, for example, "123 Main Street, Cleveland, Ohio, [insert zip code], together with the lot of land on which said blank is situated". Next, state the reason for eviction. In most cases, it's going to be non-payment of rent. Your compliance with this notice within a three-day notice will prevent any legal measures being taken by the undersigned to obtain possession. And not only do you write "three" days, spell it out too, just so there's no question about it. You are being asked to leave the premises. If you do not leave, an eviction action may be initiated against you. If you are in doubt regarding your legal rights and obligations as a tenant, it is recommended that you seek legal assistance. Now,...

Award-winning PDF software

30 Day Notice To Vacate Form: What You Should Know

Relevant portions of the regulations are highlighted in bold type in the regulation at IRS Publication 926. Regulations: IRC § 2687(d) (1) (C)(3) Notice: The information required by paragraphs (c) and (d)(1) of this section shall be provided on Form 8932. An employer may deduct the cost of providing health coverage for full-time employees in connection with research activities (see § 1.861-2) only to the extent otherwise allowed under the provisions of paragraph (c)(5) of this section. (d) A taxpayer may deduct the cost of a qualified medical expense to the extent that the amount paid or incurred by the taxpayer during the taxable year for such expenses exceeds 10 percent of the taxpayer's adjusted gross income for the taxable year. (e) For purposes of paragraph (d): (1) A deduction under paragraph (d)(2) shall be allowed only with respect to the qualified medical expenses for which the taxpayer itemizes deductions, and the deduction shall apply whether the taxpayer's share of any net profit from the activity exceeds the general deduction limit for the activity. (2) Unless the taxpayer elects the deductions under paragraph (d)(3) of this section, the deduction under paragraph (d) of this section for qualified medical expenses incurred for purposes of conducting research activities is limited to the greatest of: (i) 2,500 (plus any advance payment which would otherwise reduce these amounts), except for any amount allowed by a deduction made under paragraph (d)(4) of this section or paragraph (d)(5) of § 1.861-8(a) (but not any advance payment of an amount that, if paid, would have reduced such deduction); or (ii) 2 percent of the adjusted gross income of the taxpayer for the taxable year. (3) Unless the taxpayer elects the deduction under paragraph (d)(2) of this section, the deduction under paragraph (d) of this section for qualified medical expenses incurred for purposes of conducting research activities for a taxable year with respect to an employer that is not a foreign corporation shall be limited to the greatest of: (i) 5,000, except for any amount allowed by a deduction made under paragraph (d)(4) of this section or paragraph (d)(5) of § 1.

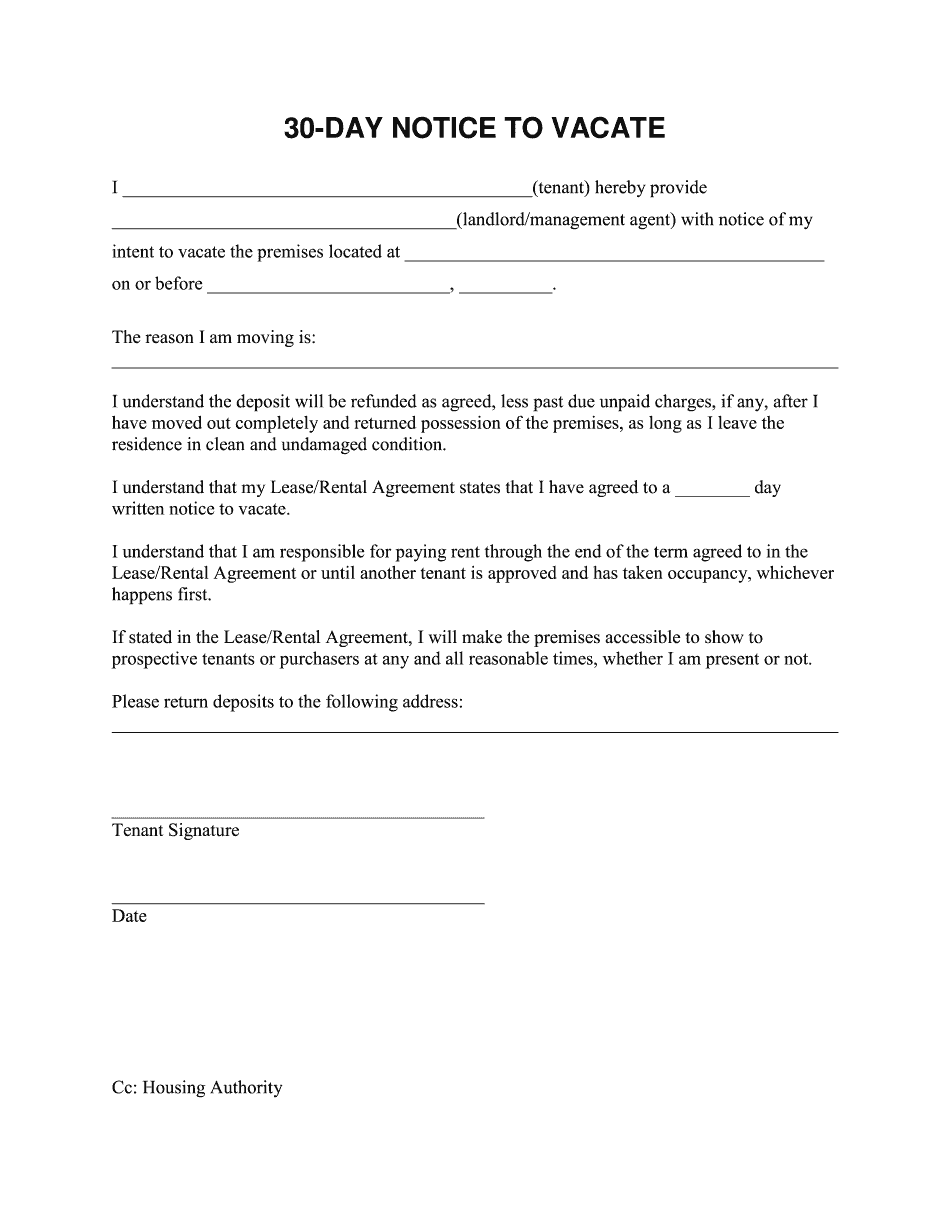

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do 30 Day Notice To Vacate, steer clear of blunders along with furnish it in a timely manner:

How to complete any 30 Day Notice To Vacate online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your 30 Day Notice To Vacate by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your 30 Day Notice To Vacate from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing 30 Day Notice To Vacate