Hello, my name is Clay Rennick and I've been practicing law for twenty years in California, specifically in the area of real estate law. Today, I'm doing a video on eviction for non-payment of rent. Statistically, nine out of ten landlord-tenant lawsuits do involve non-payment of rent. So, I thought it would be appropriate to do this video to let people know what the first stage of the process is in evicting a tenant. Okay, so let's begin. To properly terminate a tenant for non-payment of rent, you must first fill out a form called a three-day notice to pay or quit. After you properly serve the tenant, which I'll go over briefly, the tenant then has three days to make payment. If they do make payment, then this notice isn't effective and you'll have to utilize other methods for terminating the tenancy, if that is your desire to do so. However, if the tenant stays beyond the three days and fails to pay, you may then go ahead and file an unlawful detainer lawsuit. Now, that three-day period cannot end on a Saturday, Sunday, or a holiday. In those cases, you must give the tenant one extra day, and then you can begin your suit and the legal process then begins from there. Okay, if the tenant offers to pay the rent after the expiration of the three-day notice, you do not have to accept the rent payment. However, if you do accept the payment, you cannot continue with your eviction lawsuit. Prior to evicting the tenant, you must have done at least one thing in accordance with Civil Code section 1962.5. This states that the tenant must be advised, either in a separate writing or in a written lease, of the name and address of the owner or...

Award-winning PDF software

60 day notice to vacate los angeles Form: What You Should Know

Form 941 is a one-page form that reports income and tax withholding for taxes payable Form SSA Form 940 and Form 946 are two forms commonly used by small businesses, both can be ordered on Who Qualifies as an Employee? As a sole proprietor or joint proprietorship, the business owners or partners in such business should file both forms 940 and 941. Employees are the people that work for the business, including the owner or partner, and are entitled to work and be paid based on the amount of wages or other compensation paid by the business. How Much Tax Should I Pay? The amount of tax is determined based upon each individual's income. There is an annual 9,000 limit on how much tax, and withholding will be due. Most small businesses, as well as some corporations and partnerships, pay the standard Social Security and Medicare tax. If you are planning a move and moving your entire business to a new location with the new place of business, this might be an option.

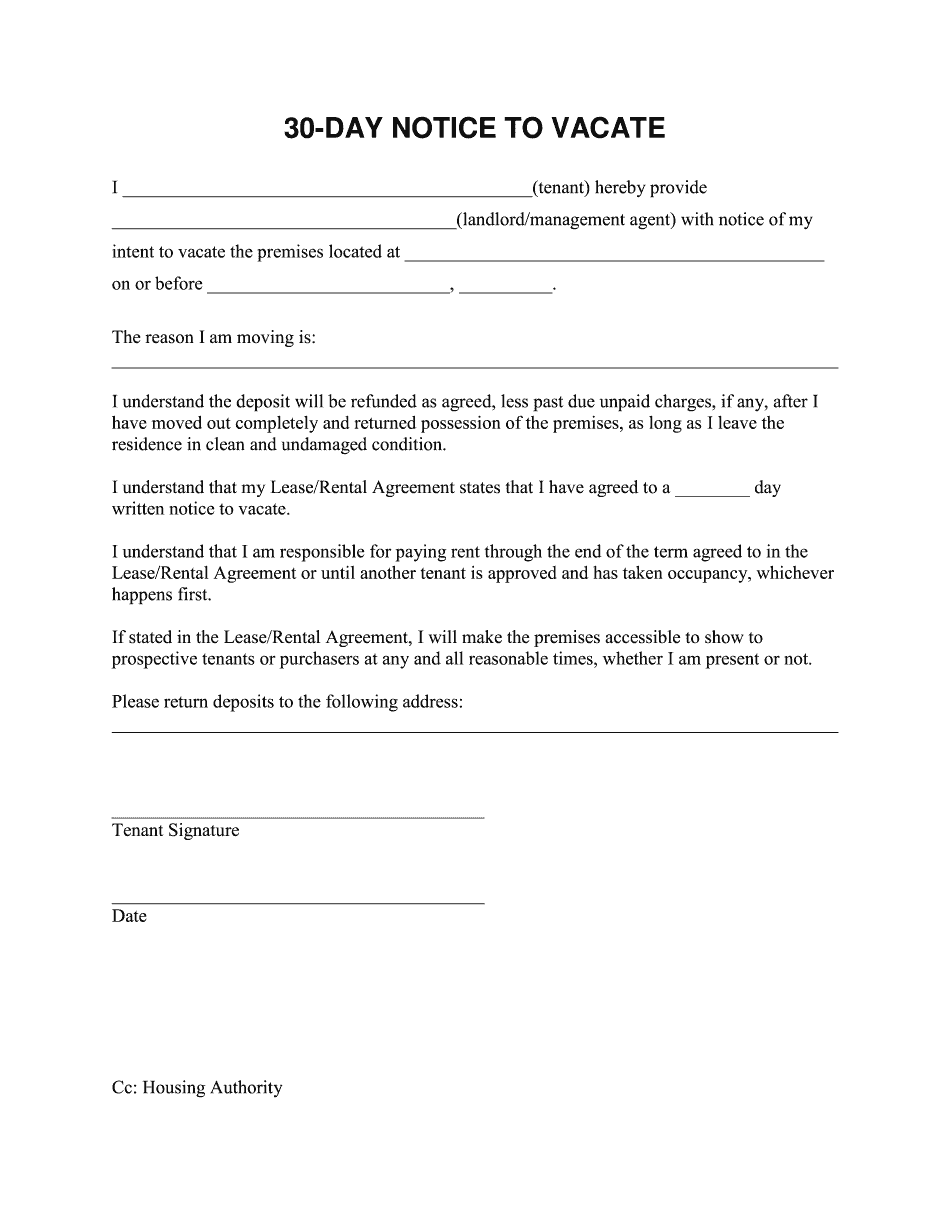

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do 30 Day Notice To Vacate, steer clear of blunders along with furnish it in a timely manner:

How to complete any 30 Day Notice To Vacate online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your 30 Day Notice To Vacate by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your 30 Day Notice To Vacate from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing 60 day notice to vacate los angeles